How to Set Up Direct Deposit

You work hard enough at your job. Who wants to further the grind by manually depositing each paycheck into their account? Enrolling in your employer’s direct deposit program gets your earnings into the financial account of your choice securely and hassle-free. Once you know how to set up direct deposit, you can rely on your hard-earned cash to be available ASAP.

Let’s break down the ins and outs of how to set up direct deposit, including our specialty: credit union direct deposit through your local credit union.

What is a Direct Deposit?

Direct deposit is a service, offered by most companies, that lets your employer send your paycheck directly to your savings or checking account. You can also use it for work-related travel reimbursements, as well as government transactions, such as tax refunds and unemployment payments.

These automatic, account-to-account payments are called Automated Clearing House (ACH) transactions. Created in the 1970s, the ACH network allows financial institutions within the U.S. to transfer money electronically. Paycheck direct deposits are some of the most common ACH transactions, but the system is also used for online bill payments, recurring monthly debit charges, and other merchant services.

How Does Direct Deposit Work?

While direct deposit transactions usually hit your account quickly, the behind-the-scenes work takes a little longer. A day or two before payday, your company sends its payroll information to its financial institution. The financial institution will then pass instructions along to the ACH system to sort payments to each employee’s financial account. When the ACH network is done working its magic, your paycheck appears in your account automatically.

How to Set Up Direct Deposit

Maybe you’re starting a new gig and wondering how to set up direct deposit. Or perhaps you’ve been getting a paper check for a while, and — although you’ll miss the free lollipops — you’ve decided you’re over the biweekly trip to your bank or credit union. Talk to your payroll department to get the ball rolling. Some companies let you sign up using an online portal, but most involve at least some paperwork.

The process is pretty similar for both bank and credit union direct deposit. Follow these three steps:

1. Decode your paper check

First, you’ll need to fill out the company’s employee direct deposit enrollment form. This will include your name, address, Social Security number, and information from your financial institution, such as account number and routing number.

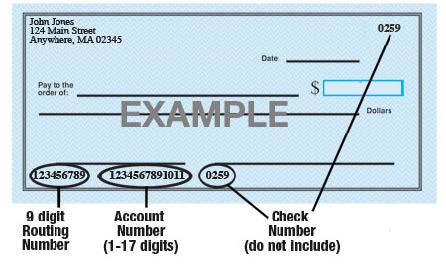

Start by identifying your account and routing numbers that you’ll need to enter on your direct deposit form. If you use a mobile banking app on your phone, it likely lists and labels these numbers pretty clearly. You can also use the old-school method by decoding a paper check — you’ll need one later in the process, anyway.

On the bottom left side of your check, you’ll find a nine-digit number between a set of separating symbols. This is your routing number, the code that tells the ACH system which financial institution holds your account. The routing number is like providing your street name when giving directions. It’s part of your specific location, but not exclusively yours.

The second set of numbers — printed between the next set of symbols — is your account number. It usually contains between eight and 12 digits. Using the directions analogy, your account number is like the unique address on your home. (Incidentally, if you’re wondering what that last, smaller set of digits means, it’s your check number — You don’t want to include those numbers on the form).

2. Determine deposit destination and submit

Once you’ve filled out the corresponding information from your check on the direct deposit form, it’s time to decide if you’ll send your money to one or more accounts. Many people simply deposit their entire paycheck into their checking account, but some employers let you split your deposit between different accounts. For example, if you’d like to funnel some of your funds toward a savings or investment account.

Now, let’s take another look at that paper check. If you’re setting up direct deposit for a checking account, you’ll likely need a voided paper check, meaning it will be unusable for payments and withdrawals. To void your check, write “VOID” in large letters across its face with blue or black ink. Cover the lines for the payee and dollar amount, but leave the routing and account numbers visible. If you’re setting up direct deposit for a savings account, you won’t have a check to attach, but your employer may request a deposit slip instead.

3. Recieve deposit verification

As you submit your handiwork, be mindful that deposit enrollment forms are an identity thief’s dream. If you work onsite, give your paperwork directly to someone in the payroll department. Remote workers, consider sending the information using a secure file transfer service or website with HTTPS or FTSP protocol.

Getting your information into the system might take a few days, but you can check with payroll to verify the process is finished. And, you can always check your account for a prenote. What is a prenote for direct deposit, you say? It’s a test transaction that your employer’s bank sends to your account to ensure everything is set up correctly.

Prenotes are usually less than one dollar, and the transactions are often reversed once everything checks out. So, if payday is getting close and you’re getting nervous, check your account for these transactions.

How Long Does Direct Deposit Take?

Once everything is set up, direct deposit payments are almost instantaneous, although the exact timing varies by the financial institution. Specifically, you may wonder, what time do credit unions post direct deposits?

In some cases, your paycheck may hit your account the day before payday. Others are posted in the wee hours of payday morning. Most payments are deposited before you could pick up a paper check at the office.

Keep in mind that some financial institutions may impose a waiting period before you can access your funds. Check your particular institution for details. But in most cases, your money arrives the same business day it was sent.

Benefits of Direct Deposit

There’s a reason more than 90% of workers in the U.S. choose to be paid using direct deposit. Actually, there are several:

- No time wasted. Direct deposit saves you time. Onsite workers who don’t have direct deposit must wait to be handed a paper check. And remote workers are dependent upon snail mail, which can take days. But with direct deposit, your paycheck hits your account almost immediately, even if you’re on vacation or out sick on payday.

- No extra trips. Direct deposit cuts down on special trips to your financial institution, too. No need to race the clock to ensure you make it to the counter before business hours are over. Sure, ATMs are an option, but no one likes to wait in the Friday carline to deposit a paycheck.

- Reliable speed and security. Direct deposit gets your money to your account fast and securely. You can’t drop an electronic transaction on a wet sidewalk or lose it between car seats like you can a paper check. And, they can’t get lost or stolen in the mail. Using direct deposit also means fewer sets of eyes regularly see your account information, Social Security number, and other sensitive details usable to steal your money or identity.

- Budget-friendly. Sending your paycheck directly to your account makes budgeting easier, too. If you deposit your check in person, holding some cash back for splurges can be tempting. Setting up direct deposit ensures that all your money arrives at its intended destination and is available for necessities, like automatic bill payments you may have set up.

Further Resources on How to Set Up Direct Deposit

Employees, employers, and even the government agree: direct deposit is a win-win. Here are some further resources on the process:

- Why stop with just your paycheck? Consider setting up direct deposit for your tax refund, too.

- No checks? No problem! The financial industry is pivoting toward younger workers' preferences, who often don’t use paper checks.

- Further benefits. Direct deposit isn’t just convenient for you; it’s also good for your employer and the environment.

Start the Weekend Right with Direct Deposit

After a long week on the job, the last thing you need is a hassle getting your paycheck to the bank. You deserve a break. Treat yourself and your money right. Use our Credit Union Locator Tool to open an account, and get started on that direct deposit paperwork.