Repair Your Credit Score in 5 Steps

Taking a look at your credit score report can feel like the adult version of getting your report card. If you didn’t exactly ace your finances, you may be wondering, how can you fix a bad credit score? Fortunately, just like those extra credit assignments your favorite teachers used to offer, there are ways to increase a credit score and get back on track. Learn how to repair your credit score in five simple steps.

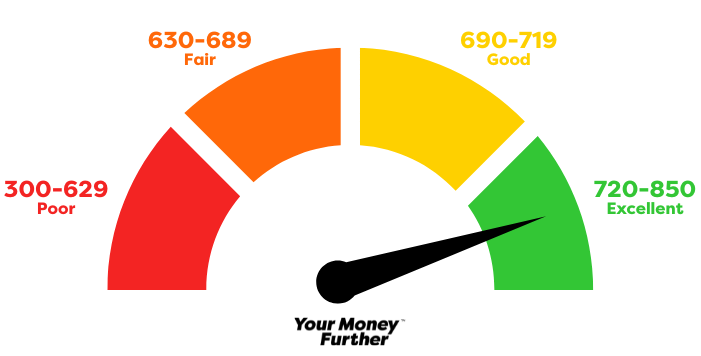

When you’re in school, tutors can help you study to pull up your grades. There are financial tutors in your adult life, too! Credit unions help with credit score issues every day, such as through credit-builder loans specifically designed to help members with less-than-ideal credit scores. But what is a good credit score, anyway? Take a look at our guide below, and use our Credit Union Locator Tool to find a local credit union near you to get started on your credit repair assignment.

What is a Good Credit Score?

Financial institutions rely on credit scores to assess a person’s creditworthiness, an estimate of how likely they are to repay a loan. Several factors go into calculating a credit score, including money owed, length of credit, payment history, types of credit available, and new credit inquiries. Luckily, the process for how to check credit score numbers is simple. Three primary credit bureaus, Experian, Equifax, and TransUnion, report credit scores.

Credit scores range from 300 to 850. The higher your credit score, the better your credit. Credit scores between 690 and 719 are considered good, with anything above 720 considered excellent. Scores below 690 are considered fair or poor and might need some work to repair your credit score.

Why Does a Good Credit Score Matter?

The report card grade from your high school gym class may not have had a big impact on your life. However, your credit score does. Credit scores affect everything from mortgage, car, and personal loan interest rates. People with higher credit scores are more likely to be offered lower-interest loans, potentially resulting in thousands of dollars in savings over the duration of the loan. Additionally, credit scores affect loan amounts and lines of credit approval. That’s why people often want to know how to increase credit score numbers.

Repair Your Credit Score in 5 Steps

Get ready to take notes because our credit score class is now in session. Here are five ways to start fixing your credit:

1. Check Your Credit Reports and Score

You need to know your starting point before you can begin fixing your credit. Generally, it’s wise to check your credit report at least once a year or before you make a major purchase, like a car or home. When checking your report, you first need to identify your credit score. If your number is above 690, you are doing pretty well! However, if you fall below 690, you will want to take steps to improve your credit.

Before you close out the document, be sure to check for any report errors. Errors could include fraudulent accounts opened under your name or simple mixups in reporting. If you come across a mistake, disputing it with the credit bureau should be your first step toward credit repair.

2. Pay Bills on Time

If your friend never paid you back after borrowing money, you’d be less likely to spot them in the future, right? Payment history is a crucial component of your credit score. Start by paying off as many overdue bills as possible and plan ahead to ensure you pay bills on time in the future. If you struggle with remembering to pay bills, consider setting up autopay. Additionally, you could create repeating calendar reminders.

3. Decrease the Debt You Owe

One of the best ways to fix a bad credit score is to decrease your revolving debts. Revolving debts are lines of credit you can continuously access as needed, like a credit card. Credit reports assess each of your credit card’s utilization ratios. People with higher credit scores tend to keep their credit card utilization below 30%.

For example, if you have a credit card limit of $10,000, try not to let your unpaid balance exceed $3,000. Try to pay off your cards frequently or update your income with your card issuer to increase your line of credit and improve your utilization ratio.

If you have credit card debt, it may feel impossible to lower your utilization ratio. But you can create an action plan to pay down your debts and get your balance down. Two popular debt depth payment techniques include the snowball and avalanche methods.

- The snowball method focuses on paying your smallest debt first with a set monthly amount. Then, once that’s paid off, you contribute that amount to the next debt, and so on. This method is excellent for people who want to start small.

- The avalanche method focuses on paying the highest interest loan first. You can save additional money down the line by paying off the highest interest. This method is excellent for people who want to save some extra cash.

While each method takes a different approach, both can be great for paying down revolving debts.

4. Keep Old Credit Cards Open

Credit cards tend to get a bad rap when it comes to improving credit scores, and many people rush into canceling their cards when they discover their score is low. While it might sound counterintuitive, if you want to know how to increase credit score numbers, credit cards can actually help. You just need to keep your balance low and pay each one off on time.

Keeping old cards open can improve your credit history because it shows you can maintain a line of credit, which can help boost your score.

5. Only Get New Credit When Necessary

While keeping old credit cards open is good, you should only apply for new cards when necessary. Applying for new lines of credit can lower your credit score. Why? Credit card applications generate an inquiry on your credit report, and credit inquiries can knock your score down a few points. (Although it will likely go back up after a few months.)

Additionally, new lines of credit lower the overall average of your credit history length. So, it’s better to stick to a few legacy credit card accounts rather than open up new ones to snag a promotion deal. Finally, applying for multiple credit cards in a short period can signal a red flag to lenders. They may suspect you are desperate to cover expenses, even if that’s not the case.

Further Resources on How to Repair Your Credit Score

Don’t forget to do your credit repair homework. Here are some additional resources to boost your credit score:

- AnnualCreditReport.com: Get a free yearly credit report authorized by the federal government — without hurting your score.

- FICO Loan Savings Calculator: Discover how much you can save on interest payments with a higher credit score.

- FICO Credit Score Calculator: Learn more about what goes into calculating your credit score.

Improve Your Credit Score with Help from a Financial Tutor

Just remember, if you need to fix a bad credit score, you’re not alone. Because credit unions regularly help with credit score issues, you’ll find many resources available to help you fix your credit score through your local credit union. Credit unions are geared toward helping their members, including setting them up for financial success. Find a credit union near you with our Credit Union Locator.