7 Ways to Ensure Your Credit Card Application Is Approved

Applying and getting approved for a credit card can be a nerve-wracking process. So, it’s important before applying to ask this important question. “How likely am I to be approved for a credit card?” This is a good question to ask yourself for three reasons. First, understanding your odds of being approved can reduce some stress. Second, having an idea of your approval odds helps you narrow your search for cards that you will likely qualify for and avoid the ones for which you don’t. Third, limiting your credit card applications can minimize negative impacts to your credit score. So, you’ll only want to apply to the credit cards you are likely to be approved for.

Read on to learn about different things to help increase your chances of getting approved for a credit card.

1. Know what your credit report says.

Your credit score is one of the biggest factors in whether you’ll be approved for a credit card. So, knowing your credit score and reviewing what’s on your credit reports can help you determine what products to apply for. A credit score is a three-digit number, ranging from 300 to 850, that signals to creditors your creditworthiness. Several factors go into your credit score, like your payment history, account balances, inquiries for new credit, delinquencies, and public records.

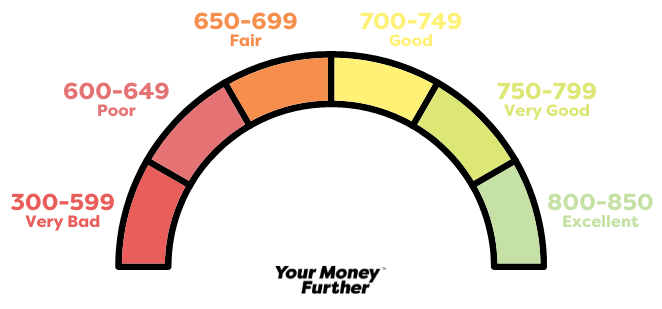

Credit card providers use your credit score to determine whether you’re likely to handle your credit card responsibly. The higher your score, the likelier you’ll be approved. You can check your credit score for free through the three nationwide credit bureaus, Equifax, Experian, and TransUnion. And while each creditor has slightly different standards for what scores they’ll accept, these are the general guidelines:

- Excellent: 800-850

- Very Good: 750-799

- Good: 700-749

- Fair: 650-699

- Poor: 600-649

- Very Bad: 300-599

As you review your credit reports, check to make sure all the information is accurate. If you see any errors, you have the right to dispute them with the credit bureau that’s reporting the information. If the bureau verifies that an error exists, they are legally required to remove it or correct it, either of which could add a few points back to your score.

2. Start building credit early.

Building credit doesn’t happen overnight – it takes time and responsible financial behavior. So, the earlier you can start building credit the better. Applicants with a lengthier credit history have a better chance of approval than those with a shorter credit history. Also, be careful when you close other cards, especially if you’ve had them for a long time. Contrary to what may seem logical, your credit score will be higher if you have several open accounts in good standing. This signals to creditors that you are financially responsible, and they will be more likely to approve you for a new credit card.

3. Have a diverse range of credit.

Another way to increase your likelihood of getting approved for a credit card is to have a diverse range of credit. Having a few different kinds of credit – loans, credit cards, etc. – will make you more appealing to creditors. When you can prove that you can regularly make on-time payments for a variety of lines of credit, you’re more likely to be deemed a reliable credit card applicant.

4. Apply only for the credit you need.

Although creditors like to see multiple lines of credit on your credit reports, it’s important to only apply for the credit you need. If you apply for multiple lines of credit over a short period of time, lenders might think your financial situation has changed for the worse, thus you need more financial help. Additionally, those hard inquiries could negatively affect your credit score.

5. Stay below your credit card limit.

Lenders keep an eye on your credit utilization, which is the total amount of credit you are using compared to the credit you have available. According to the Consumer Financial Protection Bureau, keeping a credit utilization ratio under 30% shows lenders you’re responsible and have available credit.

Need help calculating your credit utilization ratio? Don’t worry, this won’t require too much math! You’ll first need to determine two numbers: how much you owe across all revolving lines of credit and your total credit limit. Once you determine those two numbers, you’ll follow the below steps to calculate your credit utilization ratio:

- Add up all revolving credit balances.

- Add up all credit limits.

- Divide your total revolving credit balance (from #1) by your total credit limit (from #2).

- Multiply that number (from #3) by 100 to see your credit utilization as a percentage.

6. Pay more than the minimum balance and pay on time.

Whenever possible, paying more than the minimum balance due will help you lower your balances more quickly, thus helping to lower your overall credit utilization. Another benefit of paying more than the minimum balance due is that you’ll ultimately pay less in interest charges. Additionally, your payment history is a top factor that goes into determining your credit score. Just one missed or late payment can damage your credit score. So, to avoid this scenario, it may be beneficial to set up automatic payments to simplify the bill payment process. Alternatively, you can set up alerts through your bank or lender to remind you to make your payments on time.

7. Find a co-signer.

If you have no credit or poor credit, you may want to consider finding someone who will co-sign your application. A credit card cosigner is someone with good credit who applies with you and is responsible for the debt if you fail to pay. Since someone else is promising to settle the bill if you can’t, some of the risk is taken away from the credit card issuer, which could help you qualify.